A prospective student who views the world just slightly different than many others… that is exactly what universities are looking for. Readers can read up to 50 essays in a day, don’t make them guess where you fit in. Show them!

Just for Fun – Which Ivy are You?

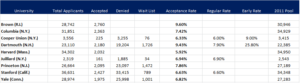

Lessons Learned from Admissions 2012

Take a College Personality Quiz

Price Check in Aisle Ivy

My dad always wears the Princeton baseball cap that I gave him freshman week, right when I started school. Whenever people ask about the tattered, sweat and bleach stained thing, he has the same response;“I paid to wear this hat”. It is probably the most expensive piece of clothing he owns! When considering a student’s four year college experience and the financial commitment necessary for a degree, images of a second mortgage may cause uneasiness in every parent. The Ivy League especially is preconceived to mean an even larger price tag. I am not here to take sides on how much an Ivy education should be worth. I do however know that financing it will work if you want it to!

My dad always wears the Princeton baseball cap that I gave him freshman week, right when I started school. Whenever people ask about the tattered, sweat and bleach stained thing, he has the same response;“I paid to wear this hat”. It is probably the most expensive piece of clothing he owns! When considering a student’s four year college experience and the financial commitment necessary for a degree, images of a second mortgage may cause uneasiness in every parent. The Ivy League especially is preconceived to mean an even larger price tag. I am not here to take sides on how much an Ivy education should be worth. I do however know that financing it will work if you want it to! That does not mean that acceptance to an Ivy immediately means giving up your retirement fund! The Ivy League, given huge endowments to work with, wants to ensure that once a student is admitted to their institution it becomes a manageable expense. All 8 schools have a need-blindadmission process to promote low-income students to apply, without concerns of the expenses. Additionally, all the aid available is used on a need basis. Need in Ivy terms may not seem “needy” to our preconceived notions. Across the board, all the Ivies offer some type of need-based aid to 50-60% of their students. Princeton has a no loans policy, allowing all students to graduate debt-free [FinAid]. In 2008, Dartmouth eliminated tuition for students from families with incomes of under $75,000 [Dartmouth Public Affairs]. Harvard and Yale have incremental expectations of how much a student should pay, from 0 to 10 percent, with family earnings of $60,000 to $120,000 a year [Fitzsimmonsand Yale Public Affairs].

Sure, it can be a blow to feel desired elsewhere and be offered nothing but admission to the Ivies. Yet, long-term, I felt Princeton offered me the opportunity to reach my potential athletically, academically, and personally. To me, it seemed like an opportunity many are not granted and I would be foolish to pass up. If it’s worth it, the investment works out – I promise!